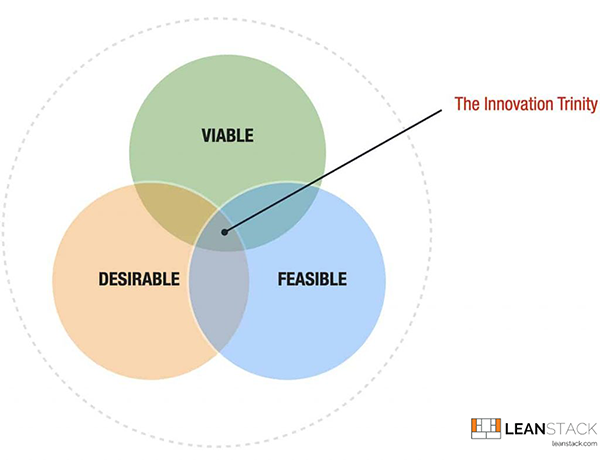

Whether you’re still validating your idea or gearing up for launch, knowing what funding and supports are out there can save you time, stress, and dead ends. The challenge is less about availability, and more about figuring out what’s worth your energy, and when.

It’s a good idea to start your research early and map out all the organisations and supports that could help you on your journey. Planning in advance is crucial, as accepting public funding can sometimes affect your eligibility for other supports (for example, you cannot be in receipt of Enterprise Ireland Pre-Seed Startup Fund (PSSF) and Local Enterprise Office (LEO) Feasibility Funding at the same time).

Many New Frontiers participants will go on to other programmes after they graduate from Phase 2 or complete Phase 3. This isn’t a case of learning the same things over again, but of deepening your knowledge, exposing yourself to new perspectives, and growing your networks. In addition, you’ll benefit from having a cohort of founders around you and access to support, advice, and (in some cases) funding.

Beyond state supports, Ireland has a large ecosystem of private investors, angel networks, and VC funds. This route typically requires giving up equity but can provide larger funding amounts and valuable business expertise. Many successful companies combine state funding with private investment to maximise their resources.

Growing through retained earnings and customer revenue remains a viable option that allows you to maintain full control and ownership. While potentially slower, this approach avoids dilution and debt obligations, and many successful Irish companies have grown this way before seeking external funding for expansion.

The below sources of support are just some of the doors you could potentially knock on. Some offer funding and some will help you prepare to raise funding elsewhere. This list is meant as a starting point only; further research based on the age of your company, sector, market, and business goals is vital.

Enterprise Ireland Innovation Voucher

Innovation Vouchers provide €5,000 towards R&D to explore a business opportunity, problem, or solution with a registered knowledge provider (such as a Technology Gateway) anywhere in Ireland and Northern Ireland. A business can apply for a maximum of four vouchers (three standard vouchers of €5,000 each) and one 50-50 co-funded (up to €10,00 matched funding). Vouchers have been used for a wide variety of projects as knowledge providers specialise in areas as diverse as bioscience research, design, civil engineering, food processing, and gamification.

New Frontiers Phase 3

Phase 2 participants may be able to apply for the limited number of spots on Phase 3 of New Frontiers. This follow-on support, with three additional months of allowance, will help you prepare to raise funding and provides introductions to government and private investment support opportunities. Many founders use the extra runway provided by Phase 3 to prepare their application for Enterprise Ireland Pre-Seed Start Fund.

Enterprise Ireland Pre-Seed Start Fund (PSSF)

The natural next step after New Frontiers, PSSF offers €50,000 or €100,000 (in two €50,000 tranches), plus access to a Client Advisor and supports such as 10 sessions with a mentor from the Enterprise Ireland panel. PSSF is open for applications all year round and is suited to companies with a minimum viable product (MVP) or Beta that are ready to push forward towards a seed round within 18 months.

Other supports from Enterprise Ireland

If you become an Enterprise Ireland client, a wide range of additional supports becomes available. What you qualify for depends on your sector and the goals of the business, which is why each company is given tailored advice on the supports to apply for. Popular supports from EI include:

- Business Financial Planning Grant

- Digital Marketing Capability

- Mentor Grant

- Market Discovery Fund

- LeanStart

- HPSU Feasibility Grant

Local Enterprise Office (LEO) supports

Local Enterprise Offices offer a range of supports, including grants, to help you start and grow a business. Many New Frontiers graduates will be focused on export potential, which will bring them under the remit of Enterprise Ireland. However, in the early days, LEO support is particularly pertinent and can provide a real boost.

Popular LEO grants for early-stage startups include Priming Grants (available within the first 18 months), Feasibility Grants for market research, and Business Expansion Grants (after the first 18 months). LEOs host webinars that cover the different grants available and workshops to help you with the grant application process (they also help with Microfinance Ireland loan applications).

LEOs have many ways to help, so it is worth exploring their full offering and calling them for an initial chat if you have questions. As well as the Start Your Own Business programme, which will introduce you to the mechanics of running a company, they host short workshops on topics ranging from patents to VAT to Instagram. This is a great way to level-up your business skillset. The full list of training programmes is available on the site of your local LEO.

National Digital Research Centre (NDRC)

NDRC is an accelerator funded by government and run by a consortium of Dogpatch Labs (Dublin), PorterShed (Galway), RDI Hub (Killorglin), and Republic of Work (Cork). The four hubs offer programmes, mentorship from experienced entrepreneurs and investors, facilities and office spaces, and warm introductions to investors and global partners.

Hosted at Dogpatch Labs, the NDRC Accelerator is a six-month programme for early-stage globally scalable tech, digital media, and consumer product startups that helps founders build their businesses and raise funding. NDRC invests €100,000 per startup using a founder-friendly, uncapped Simple Agreement for Future Equity (SAFE). The combination of funding, mentorship, office space, and network access makes this a great stepping stone after New Frontiers Phase 2, but only 13 startups participate each year.

(N.B. The NDRC will be wrapped up in 2026, to be replaced by the Enterprise Ireland-run National Accelerator Platform with a new range of supports to meet the evolving needs of founders.)

Business Innovation Centres (BICs)

BICs help start-up and scaling enterprise to access funding, mentorship, and specialised resources regionally:

- AxisBIC: Clare, Cork, Kelly and Limerick

- Furthr: Cavan, Dublin, Kildare, Louth, Meath, Monaghan, and Wicklow

- Propelor: Carlow, Kilkenny, Laois, Offaly, Tipperary, Waterford, and Wexford

- WestBIC: Donegal, Galway, Leitrim, Longford, Mayo, Roscommon, Sligo, and Westmeath

Your BIC can help you identify the best sources of financing and support with investor readiness, pitch deck preparation, and pitching to investors. They facilitate initial introductions with select investor entities, including angel investors, VCs, and international (including EU-based) investors.

You can get support with financial modelling to help secure the right type and level of funding. BICs run investment-readiness programmes to prepare applications to Pre-Seed Start Fund (PSSF), Innovative High-Potential Start-UP (iHPSU), and Prep4Seed. They also provide affordable office space and host a range of events to help you grow your network and connect with industry experts.

Regional agencies and hubs

You may also be able to find support locally from organisations such as:

InterTrade Ireland

InterTrade Ireland helps small businesses in Ireland and Northern Ireland explore cross-border markets. They support businesses in developing new products, processes, and services. They also support businesses with funding and by helping them become investor-ready. Their Acumen programme, for example, funds up to €21,562 towards the salary cost of a full-time sales employee for one year.

Údarás na Gaeltachta

Údarás na Gaeltachta offers support to businesses from a range of sectors to start up and expand in Gaeltacht regions. This includes providing grants (Feasibility Study, Priming Grant, etc.) and advice and mentoring, as well as support for finding business premises in Gaeltacht areas.

Atlantic Economic Corridor

The Atlantic Economic Corridor aims to attract investment and create jobs along the Irish western seaboard, from Kerry to Donegal. They provide free advice, support, and mentoring, plus networking opportunities for entrepreneurs starting or growing their businesses in this region.

Local hubs and networks

There are countless other groups, hubs, and clusters that support founders, providing co-working space, events, peer-to-peer learning, advice and mentorship, and generally helping to make connections and open doors. From local enterprise centres or innovation centres to business associations, chambers of commerce, and more, the supports they offer will vary and some may be backed by public funding through an agency like Enterprise Ireland while others will be private. To give you a sense of what’s out there, here are just a few examples.

- SportsTech Ireland: The SportsTech Ireland cluster – backed by Limerick City & County Council, the IDA, and Enterprise Ireland – is a geographic concentration in Europe of companies, institutions, and individuals working in the sports technology industry. It’s a dynamic and innovative ecosystem that fosters collaboration, innovation, and growth.

- Hatch Blue: The Hatch Blue & BIM Aquatech Innovation Studio (supported by Bord Iasagh Mhara (BIM)) is a high-impact innovation studio designed to help early-stage aquatech companies turn innovative ideas into scalable, market-ready solutions.

- AgTechUCD: The 12-week AgTechUCD Agccelerator Programme helps startups (agtech, agrifood, veterinary or equine sectors) to grow and scale on the national and international stage. As well as investor-readiness training, you can get support to develop your grant strategy (non-dilutive EU funding) and work on proposal writing.

- Health Innovation Hub Ireland: HIHI works across the health sector with Irish businesses to creatively solve problems and improve patient care. They can independently assess your idea for commercial potential and healthcare impact, and provide feedback and advice on next steps and funding options.

- Food Works: Food Works is an accelerator programme for globally scalable innovative food and drink startups. Run by Enterprise Ireland, Bord Bia, and Teagasc, it supports high-potential businesses to launch and scale rapidly. The programme helps founders validate their product, access research and development expertise, scale and be ready for export, and produce an investor-ready business plan.

- LaunchBox: Trinity College Dublin’s student accelerator is a summer programme open to early-stage startups. The structured programme offers access to investors and mentors and on-campus co-working space.

- The Yield Lab Europe: Yield Lab Europe is a specialist venture capital fund that invests in early-stage companies that positively impact the food and agriculture value chain. It helps disruptive, impact-driven innovations go to market and help shape sustainable agrifood systems.

The Skillnet Innovation Exchange

The Innovation Exchange connects large businesses facing innovation challenges with ambitious startups and SMEs that can help them solve these challenges through a structured, fully managed programme. This allows scaling technology companies to unlock an instant sales pipeline and gain access to key decision makers, market intelligence, and the capability to sell to large corporates.

Social Entrepreneurs Ireland

Supporting social entrepreneurs in Ireland, this organisation provides funding, mentorship, and training to social entrepreneurs who are addressing social problems and creating positive change. They don’t limit the sectors they support, but some projects they have supported in the past include education and learning, children and young people, mental health, diversity and inclusion, housing, and the environment.

Social Entrepreneurs Ireland runs a range of programmes every year, including the Impact Programme, which supports social entrepreneurs to strengthen their foundations and scale their solution for long-term impact and the Transform Programme, for founders ready to meaningfully and fundamentally change the social problem they are tackling at a national level.

Going For Growth

Co-funded by Enterprise Ireland, Going For Growth is for ambitious female founders (owner-managers of the business) with significant aspiration for growth. It uses a peer-led approach based on the shared experiences of both a Lead Entrepreneur and other participants facing common challenges. Typically, but not always, the business should have been trading for over two years. While it doesn’t provide funding, it will help you build the skills to take your business to the next level.

Accelerating the Creation Of Rural Nascent Start-ups (ACORNS)

The ACORNS programme supports early-stage female entrepreneurs living in rural Ireland (they specify you must have or intended to have a new business located outside the city boundaries of Dublin, Cork, Galway, Limerick, and Waterford). Like the Going For Growth programme, participants take part in interactive round table sessions with female entrepreneurs who have successfully started and grown their own businesses. This free programme is funded by the Department of Agriculture, Food and the Marine.

If you have a business idea, the New Frontiers programme will equip you with the right connections, the right skills, and the right route to capital to build a successful and sustainable startup business. Register your interest today!

About the author

Scarlet Bierman

Scarlet Bierman

Scarlet Bierman is a content consultant, commissioned by Enterprise Ireland to fulfil the role of Editor of the New Frontiers website. She is an expert in designing and executing ethical marketing strategies and passionate about helping businesses to develop a quality online presence.

Recent articles

Raise Your Startup’s Visibility & Credibility By Entering These Competitions

Founder Perspectives: Lessons From Building Businesses In Sustainability

Tech Startups In The Age Of AI: Alumnus Paul Savage On Speed, Quality & Risk

Fourteen Startup Founders Graduate From Phase 2 Of New Frontiers In Tallaght

Eleven Founders Graduate From New Frontiers In The Border Mid-East Region

Laying The Right Groundwork Helps Startups Prepare For Export Success

Startup In Dublin: Learn More About New Frontiers On TU Dublin’s Grangegorman Campus

Scarlet Bierman

Scarlet Bierman

3. Building grit

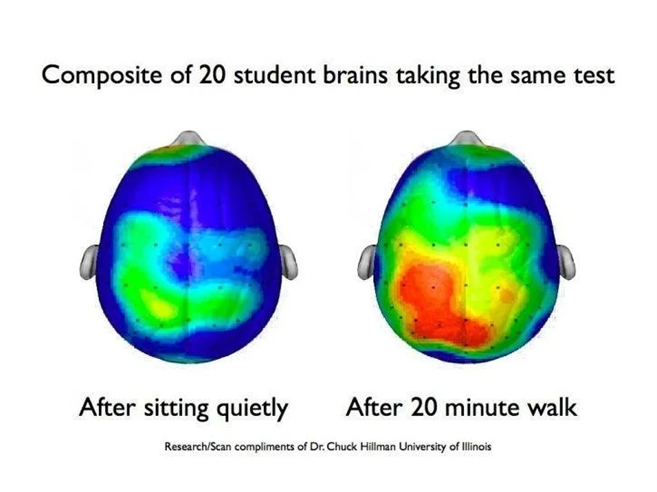

3. Building grit By nurturing your emotional health through physical activity, you develop the resilience needed to navigate the emotional highs and lows of start-up life with grace and resilience.

By nurturing your emotional health through physical activity, you develop the resilience needed to navigate the emotional highs and lows of start-up life with grace and resilience. Johnn Barron

Johnn Barron

About Gianni Matera

About Gianni Matera

Lauren and Bidemi met while completing degrees in pharmacy. In fact, they had an idea for a different promotion startup before having the lightbulb moment that led to developing the ProMotion Rewards app.

Lauren and Bidemi met while completing degrees in pharmacy. In fact, they had an idea for a different promotion startup before having the lightbulb moment that led to developing the ProMotion Rewards app.

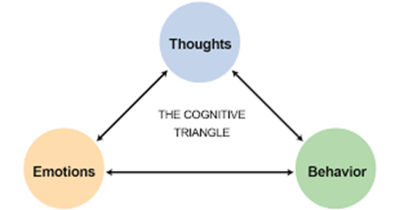

The innovator mindset

The innovator mindset

Pierce Dargan

Pierce Dargan

Finn Murphy

Finn Murphy

Orla Donohoe

Orla Donohoe

The customer-focused development process which was originally developed by

The customer-focused development process which was originally developed by  Dara Burke

Dara Burke

So what? Who cares? Why you?

So what? Who cares? Why you? Garrett Duffy

Garrett Duffy

Dominic Mullan

Dominic Mullan

Alan Costello

Alan Costello

Nicola McDonnell

Nicola McDonnell

Rachel Hanna

Rachel Hanna

Ray Mongey

Ray Mongey

Gail Condon

Gail Condon