From the day you incorporate your new business in Ireland, you’re signing up for a host of filings, deadlines, and decisions throughout the year. Corporate paperwork can be a nightmare, but making it seamless, quick, and centralised in one place is a dream that one founder hopes to make a reality.

We sat down with Stuart Connolly, experienced corporate lawyer and co-founder of Open Forest – a one-stop platform that helps startup founders navigate hundreds of legal, tax, and accounting considerations and deadlines with ease.

The first idea and the pivot

Stuart was keen to leverage the AI boom and flex his entrepreneurial muscles at the same time. He had an idea for a solution aimed at big law firms and, late in 2022, applied for a place on Phase 1 of New Frontiers. However, while on the programme, he realised that the market niche he was targeting was incredibly hard to break into.

At the same time, Stuart was helping his fellow programme participants with various legal and compliance tasks that came up for them as founders. “Half of the cohort were offering to pay us for help. My co-founder, Pourya Saber, and I were asking ourselves, ‘Why are we banging our heads against the wall trying to talk to these big law firms where there is a problem right in front of us that needs a solution?’.”

The co-founders pivoted to building the Open Forest platform and hit immediate traction. The legal service work Stuart delivered paid the bills while they scoped out their technology to work for early-stage founders. Open Forest is like a ‘company compliance operating system’. From incorporation onwards, it guides company directors through tasks such as company registration, tax registrations, and generating legal agreements. It also flags all the filing deadlines coming up, like the crucial Annual Return deadline that thousands of businesses miss every year (an expensive mistake!).

Solving real founder headaches

For those who aren’t lawyers, incorporation can be confusing and multi-faceted, so most of us will opt for a default limited company set up by an accountant or legal firm. Stuart explains that this means founders could be starting out with some fundamental flaws in the company structure that cause them issues later on.

“For example, every company that incorporates in Ireland must specify its ‘authorised share capital’, which is the total number of shares it is legally allowed to issue. Many founders set this number very low – maybe 100 or 1,000 shares – essentially not creating enough ‘headroom’ for future investment. If you decide to go for funding such as Enterprise Ireland’s PSSF, they will need plenty of shares to convert their loan note into. If you only authorised 1,000 shares total and the founders already own most of them, there aren’t enough shares available for the investor to take their required equity stake. And that’s a couple of thousand euros to put right.”

Stuart believes the key to Open Forest’s success will be in doing compliance work at scale, because law firms and accounting firms – charging by the hour – can’t compete. Across legal, tax, and accounting, there are hundreds of rules and options but no central place to go for fast, cost-effective solutions. If you don’t spend thousands a year outsourcing this, you can try to figure it all out for yourself. But Stuart warns founders who focus on governance and accounting in an effort to save cash that this is time spent away from their business and simply does it a disservice.

Building with a co-founder

It took Stuart months to find the right co-founder. Although he has some experience in programming, Stuart is the non-technical founder while Pourya – a software engineer with 20 years’ experience – handles product development. Stuart is based in Dublin and Pourya in London, and they cross over for everything.

“When you’re looking for a co-founder, you’re trying to convince another person to spend all their time, for no money, on something that’s still in your head. It’s crazy in a way, I’m amazed that anyone says yes. When we had our initial discussions, Pourya sent a questionnaire for me to fill out. It seemed a bit formal at the time but now I think it was a really good idea. Being co-founders is a kind of marriage; if all goes well, you’ll be working together for five or 10 years. Two years on, I can say that even if we have disagreements, which is natural, it smooths out and it’s been an awesome journey so far.”

The hardest part about developing Open Forest has been its complexity. With legal, compliance, tax, and accounting in one place, there are lots of intertwined compliance-related issues. Changing something in one area will have a knock-on impact in another. Stuart and Pourya have taken it slowly and, now that the product has been validated, they recently hired their first founding engineer to help speed up production.

Support and funding so far

After three MVP phases, Open Forest has been in full production for the past year. Having paying customers from day one allowed them to develop their product based on real customer needs and feedback. Stuart completed Phase 1 of New Frontiers in Blanchardstown and then Phases 2 and 3 in Tallaght. “New Frontiers was my introduction to running a business, so I feel really grateful for that. The best part of the programme is the group of peers you are with. All 18 of us are still in a WhatsApp group together; we still talk to each other and help each other out wherever we can.”

After New Frontiers, the company received €100,000 in Enterprise Ireland Pre-Seed Start Funding (PSSF). This year, Open Forest got a place on the NDRC Accelerator Programme – which provides an additional €100,000 in funding – and they received a similar amount from a private angel investor.

“In early-stage, revenue is a double-edged sword. On the one hand, it’s amazing that people are giving you money for something you made. But on the other, when you’re presenting your business to New Frontiers or the Local Enterprise Office or Enterprise Ireland, you need to keep demonstrating that what you’re building is a tech company and not a service business. We have to explain that the service element of our business was to bootstrap this part of the business and that we’ve transitioned into a tech product company that automates the legal service.”

Advice to fellow startup founders

With upcoming milestones such as the release of bookkeeping features and bank account integration, Open Forest will use its recent investment pot to hire developers as well as activities such as marketing. They are also completing the process of becoming an authorised company formation service in the UK.

Reflecting on the journey so far, Stuart fixes on early validation as vital for founders. “I came from a sector which is notorious for its long hours to doing even longer hours and never being able to disconnect from the business. It’s not for the faint of heart. You’re lucky if you’re working round the clock, because that means the business is going in the right direction.

“Like they say on New Frontiers, always validate your idea. Before anything, speak to potential customers – it will stop you going down a wrong path and then having to turn around at the end. Don’t worry about holding your idea close to your chest because execution is everything. Be sure you have a valid idea, because if you spend six or 12 months on a dead-end idea, you’ll be exhausted by the time you do find the idea that’s right. Get it right as early as possible. Yes, you can learn from failure. But if you can avoid it, you should!”

You can learn more about Open Forest at openforest.co.

About the author

Scarlet Bierman

Scarlet Bierman

Scarlet Bierman is a content consultant, commissioned by Enterprise Ireland to fulfil the role of Editor of the New Frontiers website. She is an expert in designing and executing ethical marketing strategies and passionate about helping businesses to develop a quality online presence.

Recent articles

Founder Perspectives: Lessons From Building Businesses In Sustainability

Tech Startups In The Age Of AI: Alumnus Paul Savage On Speed, Quality & Risk

Fourteen Startup Founders Graduate From Phase 2 Of New Frontiers In Tallaght

Eleven Founders Graduate From New Frontiers In The Border Mid-East Region

Laying The Right Groundwork Helps Startups Prepare For Export Success

Startup In Dublin: Learn More About New Frontiers On TU Dublin’s Grangegorman Campus

Michael Furey On The Success Of Ronspot: “The Most Important Thing Is Research”

Scarlet Bierman

Scarlet Bierman

Linda Barry

Linda Barry

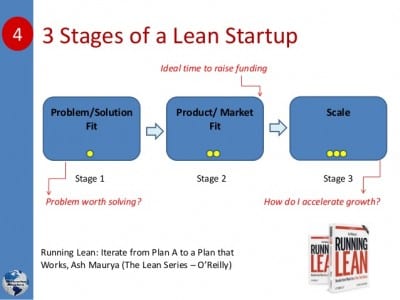

Ash Maurya’s Three Stages of a Startup

Ash Maurya’s Three Stages of a Startup

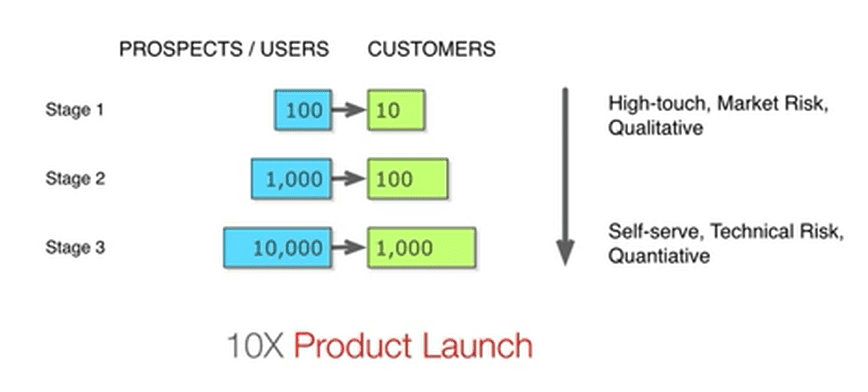

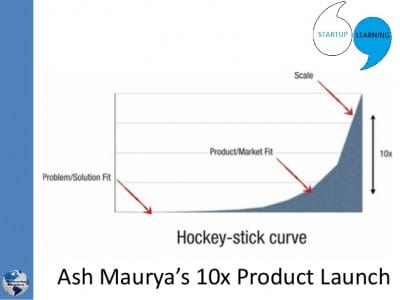

Ash Maurya’s 10x Product Launch

Ash Maurya’s 10x Product Launch

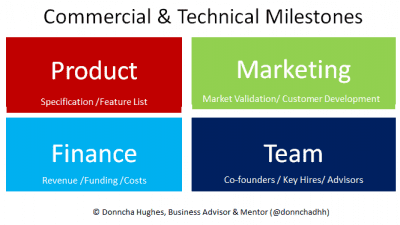

A balanced set of goals is also required. I suggest that the balance of any startup business can be evaluated in terms of balance across four areas: Product, Marketing, Finance and Team – which I refer to as the Startup Milestone Mix.

A balanced set of goals is also required. I suggest that the balance of any startup business can be evaluated in terms of balance across four areas: Product, Marketing, Finance and Team – which I refer to as the Startup Milestone Mix. Donncha Hughes

Donncha Hughes

Pete Friel

Pete Friel

Colm Ó Maolmhuire

Colm Ó Maolmhuire